UCU Personal Finance Manager: Your Financial Companion

In today’s complex financial landscape, managing personal finances has become more critical than ever. UCU Personal Finance Manager emerges as a valuable tool, offering individuals a comprehensive platform to take charge of their financial journey. In this article, we delve into the features and benefits of UCU Personal Finance Manager, exploring how it empowers users to achieve financial wellness and make informed decisions.

Understanding UCU Personal Finance Manager:

UCU Personal Finance Manager is a digital platform designed to simplify and streamline personal financial management. It brings together various tools and features that enable users to track income, monitor expenses, set budgets, and plan for future financial goals.

Key Features and Benefits:

Expense Tracking: UCU Personal Finance Manager allows users to monitor their ucu personal finance manager habits by categorizing and tracking expenses. This insight helps individuals identify areas where they can cut back and allocate funds more efficiently.

Budgeting Made Easy: Creating and maintaining a budget is a cornerstone of effective financial management. The platform provides tools to set realistic budgets, track progress, and make adjustments as needed.

Goal Setting: Whether it’s saving for a vacation, paying off debt, or building an emergency fund, UCU Personal Finance Manager enables users to set specific financial goals. It then tracks their progress, offering motivation and direction.

Financial Insights: The platform provides users with actionable insights into their financial behavior. These insights help individuals understand their spending patterns, identify trends, and make informed decisions.

Bill Payment Reminders: Late bill payments can lead to unnecessary fees and financial stress. UCU Personal Finance Manager sends reminders for upcoming bills, ensuring timely payments and avoiding penalties.

Financial Snapshot: With a visual representation of their financial status, users gain a clear overview of their assets, liabilities, and net worth. This snapshot aids in making strategic financial decisions.

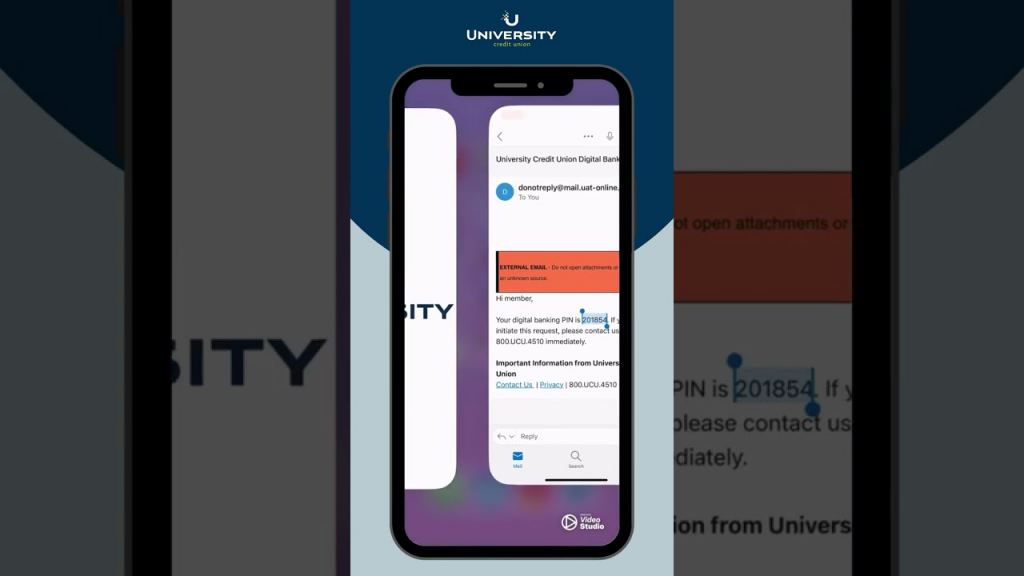

Data Security: UCU Personal Finance Manager prioritizes data security, ensuring that users’ financial information remains private and protected.

Empowering Financial Wellness:

UCU Personal Finance Manager goes beyond mere financial tracking; it empowers users to develop healthier financial habits. By promoting budgeting, goal setting, and informed decision-making, the platform fosters financial responsibility and resilience.

Conclusion:

UCU Personal Finance Manager emerges as a valuable tool in the pursuit of financial wellness. Its features and benefits equip individuals with the knowledge and tools they need to manage their finances effectively, achieve their goals, and navigate their path to a more secure financial future.