Navigating Transactions: The Role of a Credit Card Payment Processor

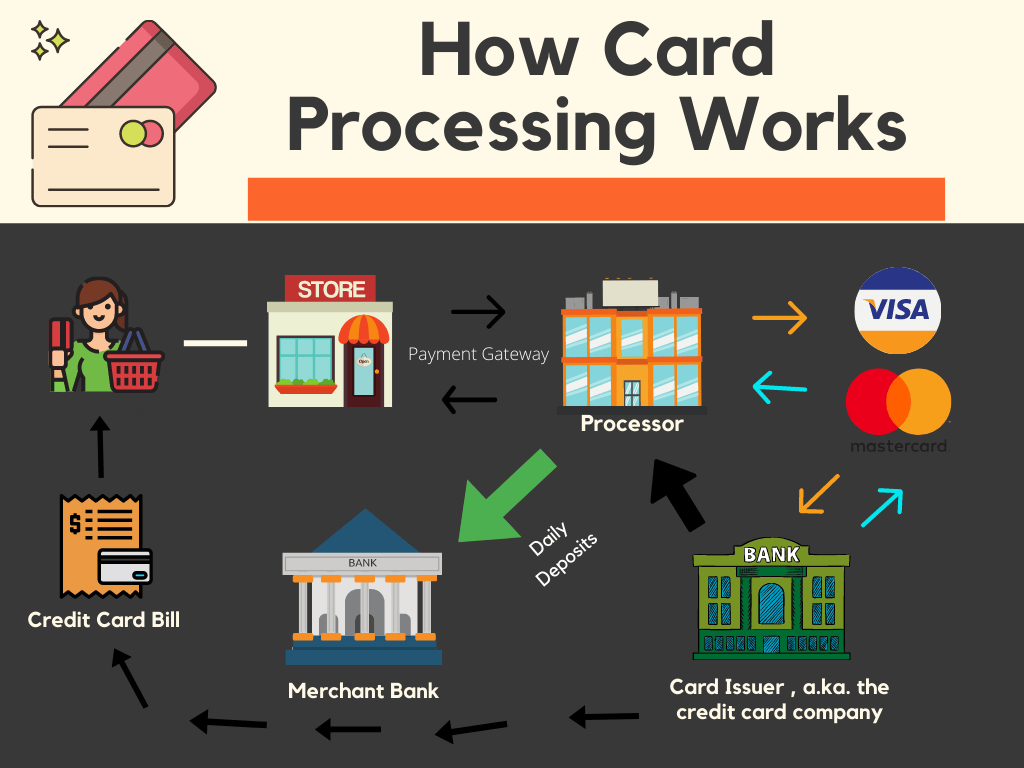

A bank card cost model represents a essential position in the current economic landscape, offering while the linchpin that facilitates electronic transactions between retailers and customers. These processors become intermediaries, linking firms with the banking system and enabling the smooth move of funds. The fact of these purpose lies in translating the info from a credit card exchange into a language understandable by economic institutions, ensuring that payments are certified, prepared, and resolved efficiently.

Among the principal features of a bank card payment processor would be to boost the effectiveness of transactions. When a customer swipes, inserts, or shoes their bank card, the cost processor quickly assesses the exchange details, communicates with the appropriate financial institutions, and validates whether the purchase can proceed. This technique happens in a matter of seconds, emphasizing the speed and real-time nature of charge card cost processing.

Protection is a paramount concern in the world of financial transactions, and bank card payment processors are at the front of implementing procedures to safeguard sensitive information. Advanced security technologies and submission with market standards make certain that client information remains protected through the payment process. These security steps not just safeguard customers but in addition instill rely upon organizations adopting electric payment methods.

The credit card payment processing ecosystem is frequently evolving, with processors changing to scientific advancements and adjusting consumer preferences. Mobile payments, contactless transactions, and the integration of electronic wallets symbolize the front of invention in this domain. Bank card cost processors perform an essential position in permitting companies to keep ahead of those tendencies, giving the infrastructure required to aid diverse payment methods.

Beyond the traditional brick-and-mortar retail space, bank card payment processors are important in driving the large landscape of e-commerce. With the increase of on the web buying, processors facilitate transactions in a virtual environment, managing the intricacies of card-not-present scenarios. The ability to easily steer the difficulties of electronic commerce underscores the versatility and versatility of credit card payment processors.

World wide commerce depends heavily on charge card cost processors to facilitate transactions across borders. These processors control currency conversions, handle global compliance demands, and make sure that firms may perform on a global scale. The interconnectedness of economic programs, supported by bank card payment processors, has developed commerce right into a truly borderless endeavor.

Charge card payment processors contribute significantly to the development and sustainability of small businesses. By providing electronic cost possibilities, these processors help smaller enterprises to grow their client base and contend on a level playing field with bigger counterparts. The convenience and how to become a payment processor of bank card cost processing solutions have grown to be important enablers for entrepreneurial ventures.

The landscape of charge card payment control also requires factors of scam prevention and regulatory compliance. Payment processors implement sturdy methods to find and reduce fraudulent activities, protecting both organizations and consumers. Additionally, keeping abreast of ever-evolving regulatory requirements guarantees that transactions adhere to legitimate requirements, reinforcing the credibility and reliability of the payment running industry.

In conclusion, credit card cost processors sort the backbone of contemporary financial transactions, facilitating the easy flow of funds between organizations and consumers. Their multifaceted role encompasses speed, protection, adaptability to technical shifts, and support for world wide commerce. As engineering continues to advance and customer tastes evolve, credit card cost processors may remain main to the dynamic landscape of electric transactions, shaping the future of commerce worldwide.